Do our self-check to see what you need to do to begin your financial journey

Preparing for your financial journey at any stage of life

(Click on a heading that relates to your situation for tips and advice).

Young & Single

- Goal Setting

- First job, managing income

- Protecting your income and assets

- Lifestyle expenses, education, travel

- Paying rent, or saving for first home

- Planning for future savings

- First investments, savings plan

In a Relationship

- Goal Setting

- Sustaining long term investment and superannuation / SMSFs

- Starting a family

- Buying a home

- Protecting your income and assets

- Buying a car

- Lifestyle expenses

- Estate planning

Relationship with Young Children

- Goal Setting

- Planning and strategies for superannuation / SMSFs

- Children's education

- * Finance - mortgage, car, renovations

- Investment strategies

- Government allowances

- Retirement goals

- Estate planning

- Protecting your family

Relationship with Adult Children

- Goal Setting

- Superannuation strategies / SMSFs

- Retirement strategies

- Pay off the mortgage and contribute to superannuation

- Protecting your income and assets

- Investment strategies

- Retirement goals

- Top retirement mistakes

- Estate planning

- Transition to retirement

Retired

- Goal setting

- Superannuation and pensions

- Reverse mortgages

- Estate planning

- Centrelink

- Upgrading the car

- Aged care planning

- Protecting your income and assets

- Downsizing home

The Value of Advice

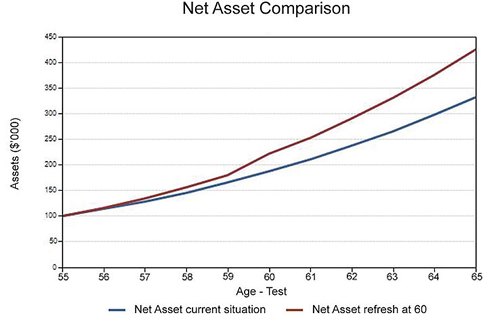

When you buy a new home or car, it's easy to see what you're actually getting. With financial advice, to really appreciate what you are paying for, you need to look at the longer term. The graph highlights the difference financial planning can make to your situation and illustrates the value of advice. It shows two situations:

Situation One - the blue line represents how much money you could have on retirement at age 65 if you do not seek financial advice.

Situation Two - the orange line shows how much extra money you could have for retirement if you seek financial advice and implement the recommended strategies.

Seeking financial advice could result in over $70,000 extra for your retirement!

Take control of your finances with Personal Wealth Portal - everything you need, in one place, accessed from your phone or computer.

Login to your Personal Wealth Portal here.

For further helpful information on your financial situation, try the following organisations and links:

We have found a number of useful calculators to help you with everything from working out a long-term savings plan through to calculating your superannuation.

General advice warning: The advice provided is general advice only as, in preparing it we did not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of this advice, you should consider how appropriate the advice is to your particular investment needs, and objectives. You should also consider the relevant Product Disclosure Statement before making any decision relating to a financial product.